When Do J-1 Visa Holders Receive Their W-2 and When Can They File Taxes?One of the most common questions among J-1 visa holders every year is simple but stressful: When will I receive my W-2, and when can I actually file my U.S. taxes? Understanding this timeline is...

Blog

The Truth About Non Resident Taxation

The Truth About Nonresident Taxation in the U.S.For many foreigners, the U.S. tax system can feel confusing and intimidating. One of the most common misconceptions is the belief that being a foreigner means having no tax rights in the United States. This belief is...

J1 Visa Taxes — Complete 2026 Guide for J-1 Visa Holders With W-2

J1 Visa Taxes (2026): Complete Guide for J-1 Visa Holders With a W-2This guide explains how J-1 visa holders with a W-2 must file U.S. taxes, which tax return to use (1040-NR), and how to estimate their refund correctly as a nonresident.Tax for j1 visa. If you're...

IRS Rules for J1 Visa Taxes: Can a J1 File Form 1040?

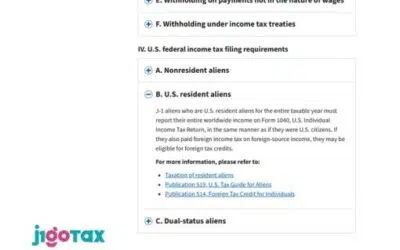

IRS Rules for J1 Visa Taxes: Can a J1 File Form 1040? (The Truth No One Talks About) Yes, a J1 Visa Holder Can File Form 1040 (And Sometimes MUST) Most J1 visa holders believe they must always file Form 1040NR for their J1 visa taxes.And that’s what almost every tax...

Where to File Your J1 Visa Taxes in Miami

How to File Your J1 Visa Taxes in Miami — Safely and Correctly (2026 IRS Guide) If you worked in Miami under a J1 visa, you are required to file your U.S. taxes — whether you are still in the United States or already returned to your home country. Miami receives...

J1 Tax Quest | Free J-1 Visa Tax Calculator & Refund Mission 2026

J1 Visa Taxes Quest: Understand Your Taxes Before You FileYour J-1 program in the U.S. was the experience of a lifetime. Your tax refund should be too. With J1 Tax Quest, you’ll calculate your J-1 visa tax refund in minutes using our exclusive tool, understand which...