Learn tax hacks

The Tax Moves Blog

BUSINESS HUB

J-1 Visa Taxes in Orlando – Guide for W-2 Workers Only

J-1 Visa Taxes in Orlando: What You Should KnowOrlando, Florida, hosts thousands of J-1 exchange visitors with...

Recent

J-1 Visa Taxes in South Bay – Guide for W-2 Workers Only

J-1 Visa Taxes in South Bay: What You Should KnowSouth Bay, including areas such as Torrance, Redondo Beach, Manhattan Beach, Hermosa Beach, Hawthorne, and El Segundo, hosts many J-1 exchange visitors with Form W-2 income only. Participants commonly work in...

J-1 Visa Taxes in Long Beach – Guide for W-2 Workers Only

J-1 Visa Taxes in Long Beach: What You Should KnowLong Beach, California, hosts thousands of J-1 exchange visitors with Form W-2 income only, particularly through programs connected to ports and logistics, hospitality, tourism, universities, healthcare facilities,...

Taxes for J-1 Visa Holders (W-2): Everything You Need to Know in the U.S.

Taxes for J-1 Visa Holders: The IRS Documents Most People Ignore (and Why Refunds Get Delayed)Many J-1 visa...

EITC & J-1 Visa Taxes: Dangerous Practices You Must Avoid

EITC, PATH Act, and J-1 Visa Taxes: The Silent System That Freezes RefundsThe problem many J-1 workers don’t see...

When Do J-1 Visa Holders Receive Their W-2 and When Can They File Taxes?

When Do J-1 Visa Holders Receive Their W-2 and When Can They File Taxes?One of the most common questions among...

The Truth About Non Resident Taxation

The Truth About Nonresident Taxation in the U.S.For many foreigners, the U.S. tax system can feel confusing and...

J1 Visa Taxes — Complete 2026 Guide for J-1 Visa Holders With W-2

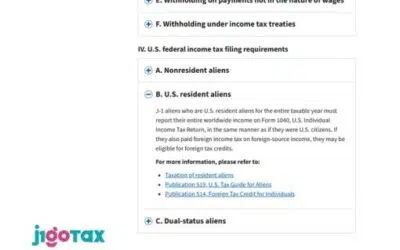

J1 Visa Taxes (2026): Complete Guide for J-1 Visa Holders With a W-2This guide explains how J-1 visa holders...

IRS Rules for J1 Visa Taxes: Can a J1 File Form 1040?

IRS Rules for J1 Visa Taxes: Can a J1 File Form 1040? (The Truth No One Talks About) Yes, a J1 Visa Holder Can...

Where to File Your J1 Visa Taxes in Miami

How to File Your J1 Visa Taxes in Miami — Safely and Correctly (2026 IRS Guide) If you worked in Miami under a...

J1 Tax Quest | Free J-1 Visa Tax Calculator & Refund Mission 2026

J1 Visa Taxes Quest: Understand Your Taxes Before You FileYour J-1 program in the U.S. was the experience of a...

How to File Your J-1 Visa Taxes in 2026 (Complete Step-by-Step Guide)

How to File Your J-1 Visa Taxes in 2026 (Step-by-Step Guide)If you worked in the United States under a J-1 visa...

How to Calculate Your J-1 Tax Refund Before Filing

How to Calculate Your J-1 Tax Refund Before Filing (2026 Edition)If you’re a J-1 visa holder getting ready for...

J-1 Visa Taxes in California – Complete 2026 Guide

J-1 Visa Taxes in California – Everything You Need to Know (2026 Guide)Do J-1 Visa Holders Pay Taxes in...

Can J-1 Visa Holders File Taxes After April?

Can J-1 Visa Holders File Taxes After April? (The IRS Says Yes — Here’s the Truth)If you’re on a J-1 visa and...

J-1 Visa Tax Return Example: How to Fill Out Form 1040NR

J-1 Visa Tax Return Example: How to Fill Out Form 1040NR (and When You Can Use Form 1040)Understanding J-1 Visa...

Top 5 Tax Treaties That Benefit J-1 Visa Holders

Top 5 U.S. Tax Treaties That Benefit J-1 Visa HoldersOne of the most powerful tools available to J-1 visa...

Top 3 Reasons Your J-1 Tax Refund Is Delayed

3 Reasons Your J-1 Tax Refund Is DelayedWaiting for your J-1 visa tax refund can feel like forever — especially...

Top Documents You Need Before Filing J-1 Visa Taxes

Top Documents You Need Before Filing J-1 Visa TaxesIf you are on a J-1 visa in the United States, filing your...

Top 3 Mistakes J-1 Visa Holders Make on Their Tax Returns (That Trigger IRS Notices)

Top 3 Mistakes J-1 Visa Holders Make on Their Tax Returns (That Trigger IRS Notices)Filing your U.S. tax return...

Top 5 IRS Notices J-1 Visa Holders Receive (And What to Do)

Top 5 IRS Notices J-1 Visa Holders Receive (And What to Do)As a J-1 visa holder navigating U.S. tax obligations,...

Why IRS Transcripts Are Essential Before Filing J-1 Visa Taxes

Why IRS Transcripts Are Essential Before Filing J-1 Visa TaxesDon’t file “blind”. The transcript is your reality...

Do J-1 Visa Holders Pay State Taxes? A State-by-State overview

Do J-1 Visa Holders Pay State Taxes?Yes. J-1 visa holders generally must pay federal and state income tax on...

The Tax Moves News

Subscribe now to our blog